The automobile industry sees fuel-efficient, low-emission, new-power (or alternative-power) vehicles and their power technology one of the next big things. The hybrids are the first and an important alternative. Battery electric vehicles (BEVs) will be one of the options but not the only one. In the next decade, we will see automakers improve fuel consumption and CO2 emission of vehicles based on gasoline and diesel internal combustion engines by enhancing the efficiency of diesel engines. They will also develop hybrids, hydrogen-powered cars, fuel cell-based automobiles and BEVs. Taiwan should take a comprehensive look at the “green” model for automobile industry by taking into account the advantages and shortcomings of electric vehicles (EVs) and keeping up with the development of new-power vehicles around the world.

New-power vehicles are inevitable!

High oil price and the financial tsunami forced a fundamental change on the global automotive, automotive electronics, automotive parts and accessories as well as automotive aftermarket industries. Green automotive parts and accessories and electronics designs are all the rage thanks to growing environmental consciousness. Big, oil-hungry automobiles are being replaced by economical and popular models as well as smaller, more sophisticated vehicles that are more energy efficient and low in CO2 emission.

Having been overly reliant on fossil fuel, the global automobile industry is actively developing next-generation new-power vehicles and alternative energy in face of drying oil supply. Existing new-power programs consist of hybrid, EV, fuel cell, hydrogen-powered internal combustion engine and new diesel engine technologies in addition to the emerging super capacitor technology. The industry and analysts are paying special attention to hybrids and EVs.

《圖一 A battery electric vehicle (BEV) from Nissan. Source: Getty Images》  |

Global Information estimates world EV sales (including HEV, PHEV and BEV) will exceed 4 million units in 2015 with compound annual growth rate of 26%, accounting for 4-5% of the world automobile sales. Strategy Analysis doesn’t expect BEVs to see high volume production until batteries are cheaper and with increased energy density. It’s estimated that global EV output will reach 3.8 million units in 2014.

Hybrids and electric vehicles on the road!

Hybrids and EVs can be categories into hybrid electric vehicle (HEV), plug-in hybrid electric vehicle (PHEV) and battery electric vehicle (BEV). In addition, Korea is developing liquefied petroleum injected HEV (LPI HEV).

Table 1. Key hybrid and BEV types and makers

Key types |

Key makers |

Hybrid electric vehicle (HEV)

(Mostly based on lithium battery technology) |

Toyota, Honda, Ford, GM, Honda, Nissan, Porsche, VW, BMW, M-Benz, BYD |

Plug-in hybrid electric vehicle (PHEV) |

NiMH battery |

GM, BuickLaCrosse, VW |

Lithium battery |

Toyota, GM, BYD, Mitsubishi |

Battery electric vehicle (BEV)

(Mostly based on lithium battery technology) |

BYD, Toyota, Nissan, Tesla Motors, Better Place, Ford, LOTUS, Chery Automobile, BMW, Mitsubishi, Subaru, Chrysler |

Liquefied petroleum injected HEV (LPI HEV)

(Mostly Korea) |

Hyundai-KIA |

Hybrid technology combines traditional petroleum engine with electric motor module(s). As traditional internal combustion engine turns a lot of energy into heat during operation, parts will wear due to friction. Electric motor(s) on hybrids recover some of the energy to reduce fuel consumption and carbon emission. However, automakers such as Toyota and Honda differ in the energy-recovery design. On the other hand, electric motor-based BEVs don’t produce exhausts and particulates while generating power, which meets the zero-emission target and effectively minimizes noise pollution, improves energy conversion efficiency, lowers energy cost, reduces parts count and revolutionized the powertrain design. Therefore it’s considered the star technology for new-power vehicles.

Automakers race to positon themselves

Automakers all over the world are quite aggressive in devleoping hybrids. Ford said it will introduce commercial BEVs in the form of vans and lithium battery-based HEVs by 2010. Nissan is expected to enter the Japanese BEV market in 2010 and mass produce BEVs by 2012. German carmakers VW and Porsche join forces in hopes of introducing HEVs in 2010. BMW, GM and M-Benz have created strategic alliances to develop similar vehicles. Korean carmakers Hyundai-KIA is working with LG, SK Energy and SB LiMotive on LPI HEVs. BYD plans to bring its PHEVs to the US market in 2011. Mitsubishi is poised to make available lithium battery-based PHEVs in the US. Chrysler plans to produce EVs in 2010 and expand the technology to all of its four brands in 2013. Porsche and VW will source hybrid system from the tier-1 automotive parts and accessory supplier Bosch in 2010.

《圖二 Mitsubishi demos a PHEV ready for production. 》  資料來源:Getty Images |

It’s evident that Li-on battery is what powers the hybrids and BEVs. Therefore automakers and tier-1 automotive parts and accessories suppliers are aggressively developing the technology to position themselves in the new-power supply chain. Japan leads the world in lithium battery technology and scale. Nissan and NEC jointly created the Automotive Energy Supply Corporation (AESC) to focus on lithium battery development. Toyota and the Matsushita created the Panasonic EV Energy Co., which will enable the introduction of BEVs in the US in 2012. Mitsubishi and GS Yuasa’s joint venture Lithium Energy Japan will develop lithium batteries. VW and Sanyo are working together to develop lithium batteries also. On the other hand, the tier-1 automotive parts and accessories supplier Bosch is working with SB LiMotive, a Samsung joint venture to develop lithium battery technology for EVs. SB LiMotive is simultaneously developing lithium battery-based BEVs and LPI HEVs. The UK automaker Lotus joins forces with the US EV maker ZAP to develop electric motor module.

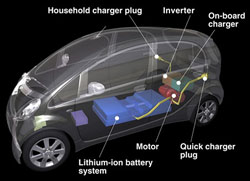

《圖三 BEV recharge system. 》  資料來源:paultan.org |

Hybrids as the first step; BEV not the only goal

It’s noteworthy that automakers all over the world are focusing on HEVs and BEVs, which means most automers sees hybrid technolgy as the starting point or interim power technology for new-power vehicles. EV is an attention getter but not the only option in new-energy automobile development. The acknowledgement is essential. Automakers are developing hybrids. That doesn’t stop them from looking into automobiles based on other power technologies. Toyota excels in the BEV area as it boasts tremendous BEV manufacturing capacity and leading lithium battery technology. Coupled with powerful marketing schemes, the Toyota advantages puts significnat pressure on its Western counterparts. However, European automakers haven’t given up on innovative diesel technology while they develops BEVs. In fact, they have applied diesel technology to smaller hybrids. US automakers continue to develop fuel cell- and hydrogen-powered vehicles. Size-wise, BEV programs should take the Mini Cooper route by creating small luxury EVs. BEVs, hybrids and hydrogen-powered vehicles will be seen in every major sports event and big exhibitions.

In other words, automakers around the world don’t consider BEV as the only way to go when it comes to new-energy vehicles. Nevertheless, lithium battery is the key to hybrids and BEVs. In order to have bargaining chips and room for negotiation, automakers must actively develop lithium technology whether BEV will dominate the scene or not.

《圖四 The first EV charging station in San Jose, USA. 》  資料來源:inhabitat.com |

China explores every new-power option

Therefore China created a strategy that will explore every new-power option instead of focusing on BEVs. In other words, China is concurrently developing hybrids, BEVs, hydrogen-powered vehicles and fuel cell-based automobiles. China’s new-power vehicles also span buses for urban areas, general commercial sedans and utility vehicles (sprinkler trucks, garbage compactor trucks, vacuum trucks, lift trucks, electrical work trucks, etc.)

China plans to set up new-power vehicle R&D centers in Changchun, Tianjin, Shanghai, Wuhan, Chongqing, Guangzhou and Shenzhen. Based on these centers, China’s Ministry of Science and Technology created a 3-year demo program that includes 10 cities and 1,000 vehicles. 13 key cities, including Chongqing, Kunming, Daliao, Changchun, Shenzhen, Changsha, Wuhan, Nanchang, Hefei, Hangzhou, Shanghai, Jinan and Beijing were selected for new-power vehicle trials. Participating automakers include Changan Automobile, the FAW Group, BYD, Hafei Automobile, DFM, Anyuan Passenger Car, Chery Automobile, Shanghai Automotive Industry, Zhongtong Bus and Beiqi Foton Motor. New-power vehicles will mushroom at Shanghai 2010 World Expo. Based on China’s automobile industry development program, EVs will account for 5-10% of Chinese automobile ownership in 2010. By manufacturing over 1.5 million EVs every year, China wants new-power vehicles to account for 10% of Chinese automobile production in 5 years.

Table 2. China’s EV ecosystem and key players

EV parts and accessories |

Key players |

Whole vehicle |

BYD, Chery Automobile, DFM, Shanghai Automotive Industry, Beiqi Foton Motor, Hafei Automobile, Wangxiang Electric Vehicle, Geely Auto, Chery Automobile, Lifan, ZX Auto |

License plate for EVs |

Zotye Auto |

Lithium battery |

Buick, BYD, Tianjin Lishen Battery, Hunan Shenzhou Science & Technology, Forever Battery, Phylion Battery, MGL, Hunan Corun New Energy |

Anode materials for lithium battery |

China Baoan, CITIC Guoan, SSGF, BYD |

Cathode materials for lithium battery |

CITIC Guoan, SSGF, CS Hairong |

Materials for making Li2CO3 |

Tibet Mining Development, CITIC Guoan, Western Mining, QHYHJT |

Source: various companies. Table: Rong-feng Zhong

It’s noteworthy that BYD is the only Chinese company that has mastered the production of LiFePO4 batteries. On the other hand, automakers including BYD, Geely Auto, Chery Automobile, Lifan and ZX Auto are developing lithium battery technology for hybrids and BEVs. Changan Automobile, Chery Automobile, the FAW Group, GM LaCrosse and other automakers are developing NiMH battery. In other words, automakers play a key role in China’s new-power vehicle strategy.

Taiwan’s EV parts and accessories supply chain near completion

Taiwan government’s policy and budget are focused on BEVs. Since Taiwan are somewhat lacking in the automaker department, it has only two BEV makers: Haitec, a Yulon subsidiary and Luxgen. Therefore Taiwan’s BEV industry consists mostly of suppliers of parts and accessories for electric motor and battery. As a result, Taiwan parts and accessories suppliers most be responsive to interational automakers’ moves in order to seek close collaboration with automakers around the world. For example, Fukuta Motor, Gongin Precision Industrial and Chroma ATE provide the US BEV maker Tesla with electric motors, powertrain parts and accessories, battery control boards, motor drivers and other electromechanical components as well as control electronics. E-One Moli Energy supplies lithium battery cells to BMW’s BEV program and works with the EV pioneer AC Propulsion (ACP) and Ford on lithium battery technology. Having licensed anode material technology for LiFePO4 from Canada, Pihsiang Energy Technology makes lithium battery for a French automaker.

That’s why the controversial ECFA issue is so important to Taiwan automotive parts and accessories suppliers. Only through ECFA can the Taiwan companies – as parts and accessories suppliers for traditional fossil-fuel automobiles and BEVs of the future – work with Chinese automakers to create a new supply chain for automotive parts and accessories and enter the automotive manufacturing market in China.

We must not be so naïve as to believe China’s automakers will welcome Taiwan companies to compete in their arena. While having expectation for ECFA, the Taiwan companies must secure their position and strengths as international suppliers of BEV parts and accessories.

Table 3. Key items and players in Taiwan’s BEV parts and accessories supply chain

Key items |

Key players |

Integrated development |

Haitec (Yulon), Pihsiang Energy Technology, Taiwan Automobile Research Consortium (TARC) |

Electric motor |

Teco, Delta Electronics, Shihlin Electric, Fukuta Motor, Gongin Precision Industrial, Joy Ride Tech |

Motor driver |

Delta Electronics, Chroma ATE |

Lithium battery |

E-One Moli Energy (Taiwan Cement), Synergy ScienTech, Pihsiang Energy Technology, Ultralife Batteries, High Energy Battery, EXA Energy, Amita Technologies, Power Source Energy, LynoPower, Gold Peak (GP) |

Power conversion system |

Delta Electronics, Chroma ATE, Cyntec |

Battery anode material |

Changs Ascending Enterprise (Formosa Plastic), Advanced Lithium Electrochemistry, San Chih Semiconductor (Tatung), Hirose Tech |

Battery cell |

Pihsiang Energy Technology, E-One Moli Energy, Amita Technologies, Gold Peak (GP) |

Battery module |

Simplo Technology (Foxconn), Dynapack International Technology (TSMC), Welldone, E-One Moli Energy |

Battery module assembly |

Pihsiang Energy Technology, E-One Moli Energy, Amita Technologies, Lifebatt, TD HiTech Energy |

Battery management |

Delta Electronics, Chroma ATE |

A long way to go for BEV commercialization

Though expectation for BEV is high, the fact is BEV has not come of age in terms of battery technology, market size, volume manufacturing capability and vehicle price. It’s in no condition for high volume manufacturing and commercialization.

First, EV batteries will need improved energy density and faster charging time. Batteries must be priced to meet the market needs. Moreover, EVs are not convenient to use due to the lack of external support infrastructures such as charging stations. There is room for improvement when it comes to batteries’ power-generation performance. EVs’ battery systems are also too expensive, which is the biggest obstacle to the commercialization of these vehicles. In addition, lithium batteries create pollution. We must take a hard look at the environmental and recycling cost and potentially serious pollution problem. Another problem is the cost of BEVs. US$ 100,000 is just too much. Though BEVs can cruise up to 400 km on a 3.5-hour charge, consumer acceptance and commercialization may require an even longer range and a sub-US$ 50,000 price tag.